FMO’s core business throughout the years has been providing debt and equity financing to private enterprises and financial institutions based in developing and emerging economies. Within our core business, we believe focus increases the quality of investments, thereby improving risk management, the service level that is provided to borrowers and investee companies, and the development impact investments will ultimately generate.

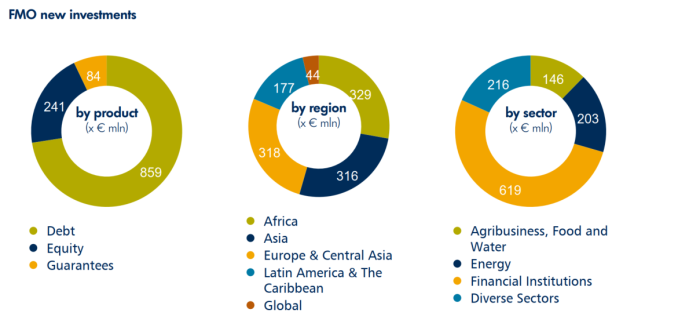

FMO has therefore chosen to focus on Access to Finance, Access to Energy, and Access to Food, implemented through a clear focus on financial sector, energy and agribusiness, food & water. For countries as a whole, these sectors are essential to achieve economic growth. For people, improved access to these basic goods and services leads to essential social progress. In these sectors we have the scale and expertise required to make sound investments ourselves. In other sectors FMO will usually finance in partnerships with our global network to complement its expertise.FMO Investment Management creates access to investments made by or alongside FMO. This means that every investment must first be a suitable investment for FMO before it is offered to any of the funds we work for. In order to secure optimal alignment FMO will maintain a substantial part of the financing for its own risk and account.